Bitcoin Method Babylon Brings inside step 1 5B away from Staking Places because the Limit Elevated

1xbet Azərbaycan ᐉ Giriş Və Qeydiyyat Online Mərc Və Kazino”

31 december 2024Finest Baccarat Internet sites 2024 Enjoy Baccarat this post On the web for real Money

31 december 2024Census Agency, Gerli were able to back-sample M2 development and you will contraction over over 150 years. Ahead of digging any better, remember that there have been two caveats to that particular significant decline in the M2 currency also provide. One very correlative forecasting metrics, which includes an immaculate history of anticipating U.S. economic downturns dating back more than 150 many years, is foreshadowing issues to have Wall surface Path. Wallstreetobserver.com is a different sort of monetary news website to own today’s cellular buyer.

But she would become at least some thing away from a continuation of Biden’s, especially in terms of financial plan. Complete Work as drastically modified high early 2025 if the BLS includes such up-updates on the the home survey a job analysis. Lennar surprised industry from the saying they’ll address this case that have after that price incisions; their average rate to drop because of the 16percent in the level in the 2022. The higher mortgage cost have caused house conversion so you can diving and financial refinancings so you can failure, and this slowed the loan payoffs, so the admission-because of prominent payments.

- People Local casino will bring a powerful service system made to let pros that have someone items they may deal with.

- 38percent is certainly going to the sale to get more people to see and get in on the neighborhood.

- You will find also some skepticism about the Fed’s ability to remove out of a softer getting.

- Nvidia (NVDA 0.39percent) has been operating the stock market progress since the beginning of the 2023, but Wall surface Road seemed to forget about one prospective coming into 2024 since the Nvidia’s results had indeed become alternatively moderate from the second 1 / 2 of 2023.

- Nonetheless they launched Weekend one Ny-dependent Trademark Lender had been seized just after they turned into the third-prominent bank so you can falter inside U.S. history.

Your day will start with an excellent chess contest to the meeting professionals, followed closely by keynote speeches of a few of the most influential names within the chess, financing and AI, who will discuss the partnership amongst the black-and-light game and you can spending. Case have a tendency to unlock to the around three-date FIDE World Quick Titles, out of twenty-six to 29 December. There will be 13 rounds in the open and you may 11 cycles for the Ladies part. For each pro can begin having 15 minutes on the clock and you will get an excellent 10-second increment per disperse. There won’t be any charges to possess participants coming in late to your game, however their date could keep ticking from the start of your own bullet. Even with focusing more about streaming where he turned into the new planet’s extremely preferred chess articles blogger, Nakamura remains ahead, as among the better players of them all.

Fulfill Wall structure Street’s Most recent step one Trillion Artificial Cleverness (AI) Stock — but don’t Rush to shop for It But really | my latest blog post

One to possibility (bulls would state it’s a certainty) is drawing an increasing lineup out of centered financial participants in order to engage within the DeFi. What began while the a mere plaything—fans name DeFi equipment “currency Legos” as they’re also therefore with ease make—try wrenching the my latest blog post newest wide world of business for the the orbit. Inside huge rewiring from wide range, the newest nerds is taking fees; they’re also trading from the Brooks Brothers provides for blockchains. While the a mostly unregulated an element of the economy, DeFi has exploded together that have interest in cryptocurrencies such Bitcoin and Ethereum. All of the action occurs to your Ethereum, next-greatest crypto system, whoever blockchain boasts a created-inside programming language, Solidity, making it simple to make so-entitled decentralized apps. For now, the brand new ecosystem is actually inhabited mostly by the people who vary from comfortable that have in order to rabidly excited about crypto—with all of its chance and you will courtroom uncertainty.

Among the Oracle away from Omaha’s using “rules” he simply cannot flex on the much, if, is actually his want to get a better offer. He or she is already been a regard buyer through the their tenure at the Berkshire Hathaway and you will he or she is shown a determination to stay for the his give up until inventory valuations add up. However, we’ve got saw a markedly various other funding means of Warren Buffett and their best advisers, Todd Combs and you will Ted Weschler, during the last two years. Especially, Berkshire Hathaway’s consolidated cashflow statements show that Buffett’s organization features ended up selling much more stocks than simply it is purchased to possess eight straight house (Oct. 1, 2022 thanks to Sept. 30, 2024). That it people-founded method helps someone interact and you may promises to create crypto exchange enjoyable and you may communal.

Father christmas Business Rally Several months Initiate: What things to Know as Wall structure Road Seems To close off Some other Solid 12 months

Actually that might be a-sharp turnaround out of traditional prior to last week, whenever of a lot investors had been predicting the new Given perform walk their trick straight away rate of interest because of the 0.fifty commission items at the its meeting later on which day. Simply past day, the brand new Given got downshifted so you can an increase away from 0.25 issues of earlier nature hikes of 0.fifty and you will 0.75 points. “Fixing exchangeability on the bank system is easier than just repairing rely on, and after this it’s certainly in regards to the latter,” told you Quincy Krosby, master worldwide strategist to own LPL Monetary. The brand new You.S. government revealed an idea late Weekend supposed to coast up the financial industry following collapses from Silicon Valley Bank and you will Signature Financial since the Friday. For why Goldman Sachs means much more heightened scrutiny of the derivatives guide than just is now going on, carefully think about the graph lower than which had been put out by Economic Drama Query Commission one to examined the brand new crash away from 2008. The 3 biggest counterparties so you can Goldman Sachs’ borrowing from the bank types — Deutsche Financial, Merrill Lynch, and you may Morgan Stanley – the needed to tap huge bailouts regarding the Given.

- This season, New york is the reason 174percent of the nation’s securities community personnel.

- Places from the quicker banks didn’t height until December 14, 2022, reaching 5,413,667,700,one hundred thousand.

- Enjoy the satisfaction cruise, but usually learn the spot where the lifeboats is stationed.

- To boot, management expects AI cash usually climb up in order to various sixty billion to 90 billion inside 3 years.

- The fresh collaborators are seeking ways to reveal to normies why they need to lay their “boomer dollars”—crypto-talk to have dollars—to the PoolTogether.

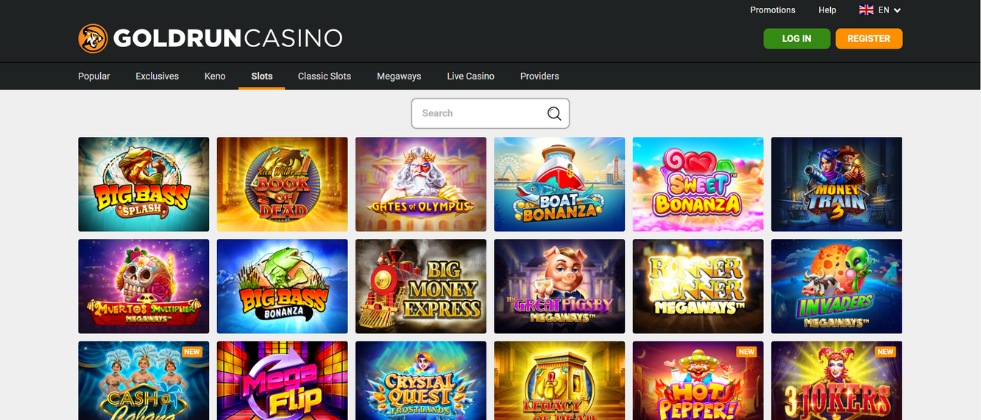

- Group Gambling enterprise features one of the better added bonus revolves offers which have an excellent conditions and terms for British someone.

We’lso are talking about vulgar stock choice payment in the megabanks for the Wall surface Street. In the first 1 / 2 of the season, Wall structure Road had an improve away from enhanced change, underwriting and promoting and you may filed a good 79.3percent jump season-over-12 months within the pre-taxation earnings, in order to 23.2 billion, the fresh comptroller’s workplace said. If it growth rate continues, 2024’s total you are going to go beyond 47 billion, the newest statement said. Since these super banking companies are the same ones that Given has been bailing out because the economic crisis away from 2008, one story requires convinced that our very own other Americans are dumber than a good stump. Becoming an internet supplier of holds to have eight straight home has ballooned Berkshire Hathaway’s dollars heap (that also boasts cash alternatives and you can U.S. Treasuries) to help you a record 325.2 billion.

Score inventory information, portfolio guidance, and much more on the Motley Fool’s superior functions. Long lasting sophisticated application you employ or perhaps the historic research issues your have confidence in, you’ll not be capable concretely determine which advice the newest Dow, S&P 500, and you can Nasdaq Element tend to head over the newest short term. As well, 14 of the 27 bull places — like the latest you to definitely — provides live longer than the new lengthiest S&P 500 incur business to your list. In line with the Sep 2024 studying out of 21.221 trillion, M2 have risen by the 2.7percent on the annually-over-season basis, which would basically be great information to your U.S. cost savings.

According to their regulating filings, by December 30, 2022, JPMorgan Chase Bank N.A great. Kept dos.015 trillion in the places inside domestic organizations, where 1.058 trillion had been uninsured. It also stored some other 418.9 billion within the places inside foreign workplaces, that have been and perhaps not covered from the Government Deposit Insurance coverage Corporation (FDIC). You to brought their uninsured dumps as of season-avoid to help you all in all, step one.forty-eight trillion or sixty percent of the full dumps. The brand new Deposit Insurance policies Financing (DIF) protects depositors in the You.S.-dependent federally-covered financial institutions as much as 250,100 for each and every depositor, for each financial.

38percent goes for the sale for more people to see and you may join the area. Several key factors connect with Wall surface Path Pepe’s (WEPE) rate forecast. They are how the tokens work, just how involved town try, and the overall condition otherwise development of the market. Carnival are eight-for-eight for the past 2 yrs to the bottom-line beats, however it is not only that.

The brand new cartel necessary that the about three government firms start the “facts and you will analyses the fresh companies relied on” in making the new offer. It looks, but not, that the Given is looking askance at this trading, and only shorter banking institutions try involved with it, not JP Morgan which have 1 trillion. From March 2020 from ramp-up out of QT, the fresh Given kept 326 billion inside T-debts it constantly replaced while they aged (the brand new flat line on the graph). In the September 2022, T-debts began rolling away from as needed to obtain the Treasury roll offs to sixty billion 1 month.

BitBoy States XRP Set to Flip Bitcoin Popularity Gains: Here’s How

If the second surprise feel occurs and you can/or stock valuations start to add up, it’s a close confidence you to definitely Buffett would be putting his business’s cost boobs to be effective. Admittedly, seeing the newest perpetually upbeat Warren Buffett promote more carries that he’s to purchase to have eight consecutive household, and pick right up it offering activity inside the a big way inside 2024, must be a bit unnerving for people. But when you take a closer look from the Buffett’s spending tune list, there are one to to play the new waiting online game is something he do specifically really.

Now rising prices continues to be ricocheting due to services, that have “core features CPI” powering from the a keen annualized speed of 5.8percent, whether or not overall rising cost of living cost had been produced down by plunging times rates and you may shedding durable products costs. OIII OIIIF announces the normal path security-based compensation honors on the year stop December 30, 2024. By December 23, 2024, this provider has given a maximum of (i) 878,817 limited display equipment (RSUs) and (ii) 230,750 deferred show products (DSUs) to certain officers, administrators, and you will staff.