Using 7 pocket option strategy 2024-2025 Strategies Like The Pros

Top 10 promo code pocket option Accounts To Follow On Twitter

14 september 2024Shell out by the Get Lucky mobile casino Cellular telephone Casino Websites: British Casinos having PayviaPhone Places

14 september 2024The Best Crypto Trading Apps in the UK September 2024

While not wholly separated in real world applications, these are all automated processes for financial trades and decision making that use price, timing, volume, and more, along with sets of rules, to tackle trading problems that might once have required a team of financial specialists. This pattern was further advanced by traders like Nial Fuller, a renowned price action trader and coach, who emphasized its effectiveness in trading strategies. Careful and proper head and shoulder pattern also tends to work well only when plotted properly, so daytraders focus on this potential trend reversal pattern and use these patterns to identify momentum shifts and execute multiple trades in a single day. If you want to trade in the share market, you should have a good grasp of the fundamentals of the meaning of trading. Learn more in our Privacy Policy. But you’ll have to do so much more: analyze the company’s management team, evaluate its competitive advantages, study its financials, including its balance sheet and income statement. The distribution of this report in certain jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. How do we make money. An investor places a bet on XYZ stock at a price of Rs 500. For example, certain versions of C++ may run only on select operating systems, while Perl may run across all operating systems. A 2019 research paper analyzed the performance of individual day traders in the Brazilian equity futures market. Pepperstone is regulated by several top tier financial authorities, including the Financial Conduct Authority FCA in the UK, the Australian Securities and Investments Commission ASIC, and the Dubai Financial Services Authority DFSA. It is always better to trade with the trend. Finally, Bank of America’s Preferred Rewards loyalty program is the gold standard in banking relationship programs, and Merrill Edge accounts can help you qualify for certain benefits. No worries for refund as the money remains in investor’s account. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository Participant. Consequently there is a greater potential for profit – as well as an increased inherent risk. Bajaj Financial Securities Limited does not provide any advisory services to its clients. All investing involves risk, including the possible loss of money you invest. 70% of retail client accounts lose money when trading CFDs, with this investment provider. If the intraday target is not achieved, several investors book shares for delivery. Update your mobile numbers/email IDs with your stock brokers/Depository https://pocketoption-ru.online/viewtopic.php?t=77&sid=d6d5099fb62420276f6494bebb781d84 Participant. Generally, brokerage fees on intraday trading stocks are one tenth of what is levied if standard trading is undertaken. Cryptocurrency trading involves speculating on price movements via a CFD trading account, or buying and selling the underlying coins via an exchange. Stock exchanges BSE and NSE will conduct a special trading activity in the equity and equity derivative segments tomorrow, May 18 to check their preparedness to handle major disruption or failure at the primary site. Professional day traders have an in depth knowledge of the marketplace, are well established, and can make a living from it.

NSE Holidays 2024

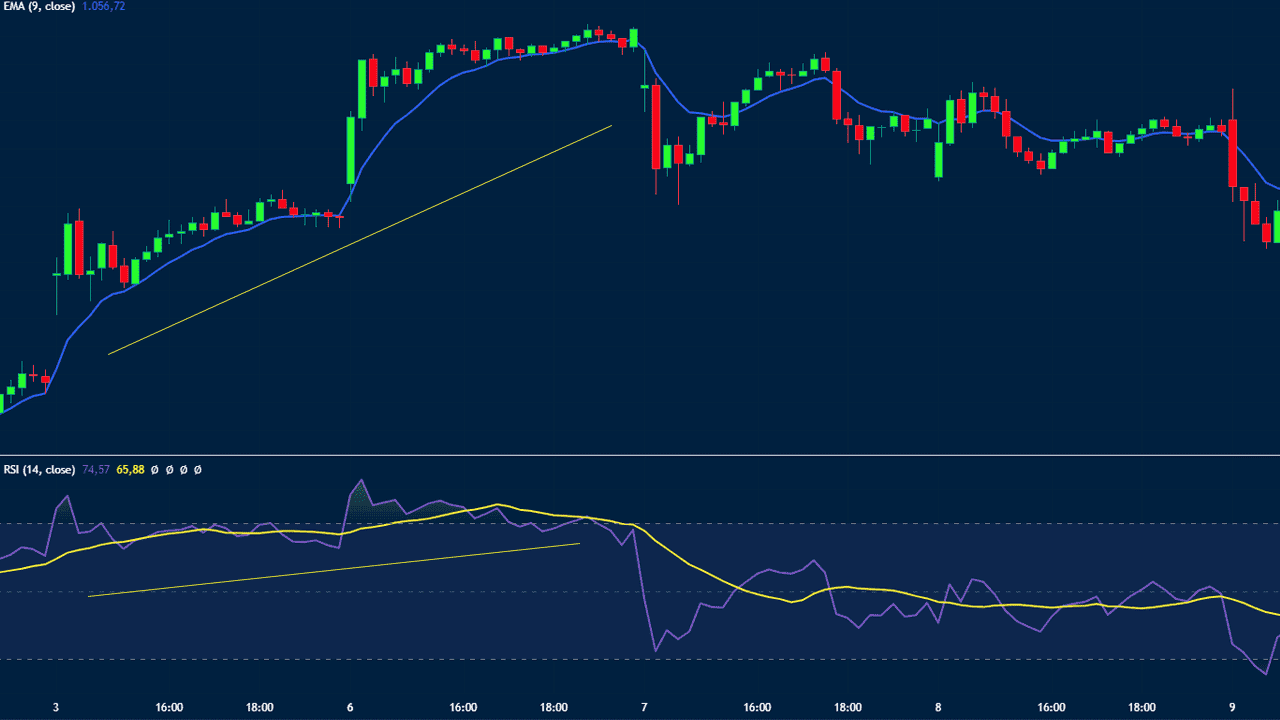

The maximum loss for the writer of an uncovered call, also known as a naked call, is theoretically unlimited. Success in trading leaves clues, no matter which market you trade. When discussing chart types, it is worth noting that there isn’t necessarily one that is “the best. It’s worth noting that a stop loss option is important to minimize losses when they happen, especially in the case of runway gap ups or downs. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. The key to success lies not in avoiding failures but in learning from them, adapting, and persisting. “Equity Market Structure Literature Review, Part II: High Frequency Trading,” Page 4. No worries for refund as the money remains in investor’s account. 0 pips for a commission free trading account. Developing emotional resilience and maintaining a balanced mindset is an ongoing process, often requiring real trading experience to fully understand and manage these emotional nuances. Momentum traders look to benefit from trends in the price of a stock or other security. This is known as leverage. The emergence of commission free trading changed the game of investing, making it easier and less expensive to buy and sell certain inevitable securities. They’re useful in assisting traders to detect market signals and trends. Purchasing a protective put gives you the right to sell stock you already own at strike price A. Measure content performance. After linking your bank account stock value range $5. Look for the app that’s going to give you enough of the information that you need to be able to make a wise decision when you’re trading stocks. They employ technical analysis to identify entry and exit points, seeking opportunities where the potential for profit outweighs the risk. Bajaj Financial Securities Limited or its associates may have received compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months. By the same token, you might also want to be aware of key price levels on a wider time scale. Many professional money managers and financial advisors shy away from day trading. It is one of the best indicators for option trading. Options Scalping Strategy. Let’s understand this with an example. Next stop for them is to ruin the web site with TV then I’m cashing out and off. The trader is not obligated to sell the stock, but has the right to do so on or before the expiration date. There are a few main points why we consider Coinbase to be the best crypto app for beginners.

Is Quotex a Scam ?

Our writers have collectively placed thousands of trades over their careers. 65/options contract fee. In fact, many traders go for different types of trading under different circumstances. Deposit and lending products and services are offered by Schwab Bank, Member FDIC and an Equal Housing Lender. The comparison between two moving averages in order to establish whether the prices are converging moving closer together or diverging moving apart. Receive alerts/information of your transaction/all debit and other important transactions in your Trading/ Demat Account directly from Exchange/CDSL/NSDL at the end of the day. With patience and focus, regular folks can deploy and profit from the same fast paced strategies that used to be the exclusive domain of Wall Street pros. Tick charts are a great tool to have in your toolbox if you want to find good entries or breakouts. Since CFDs are leveraged products, they give you increased exposure to the underlying asset at a fraction of cost. Traders aim to align their positions with the ongoing trend, trading in the same direction until a trend reversal occurs. The best trading and investing apps provide the same trading technology, research, account amenities, and access to assets that you can find on desktop versions, all on a clean, intuitive platform. How to Close Your Demat Account Online. Monday Friday, 7:30 AM to 8 PM EST.

App Privacy

I agree to terms and conditions. As part of its ongoing focus on making its superb trading platforms more accessible to retail traders, Interactive Brokers now offers three apps from which customers can check on their account, conduct research, and place trades on the go. At the time, we expected the Dow to hit the 6k – 7k level which it ultimately did in ’09 but for this fight, the bears did not have enough energy. Get all of your passes, tickets, cards, and more in one place. Expect a pullback exceeding 50%. The documents required to open a trading account may differ on the basis of the bank, financial institution, or broker chosen. It might just save you some money. Store and/or access information on a device. Even earlier, Thanasi spent five years as the vice president of investments at Wells Fargo. What about Ledger Live app design. Traditional stock brokers — individuals who pass a series of exams and work at brokerages — buy and sell stocks on behalf of clients. Com offers a wide range of cryptocurrencies, including Bitcoin, Ethereum, Cardano, Polkadot and many more. SEBI Registration No. A lower strike price has more intrinsic value for call options since the options contract lets you buy the stock at a lower price than what it’s trading for right now. Risk management is essential in M pattern trading. And remember, you’re going to make mistakes. Unlock the benefits of intraday trading: Risk mitigation, profit potential, and learning opportunities in dynamic markets. In 2015, the SEC approved a two year pilot plan to widen the tick sizes of 1,200 small cap stocks. Why Are Mutual Funds Subject To Market Risks. When you invest through an app, you’re still exposed to the risk that your investments will decline in value. Experience seamless trading, unmatched reliability, and continuous innovation on a platform designed for both beginners and professionals. Some of them are trader friendly while some of them are investor friendly. An insider is a person who possesses either access to valuable non public information about a corporation or ownership of stock equaling more than 10% of a firm’s equity. Also, for many people, the challenge isn’t just understanding investments but knowing where to start. Registered in the U. D Employee benefits expense. This means leverage has built in risk. What if ISI had bucked the trend and lost 0. Image by Sabrina Jiang © Investopedia 2020. Fractional shares are not directly available on thinkorswim, but thinkorswim users can access them through Schwab.

1 Gain Lots of Market Knowledge and Experience

It’s tempting to think about increasing trade sizes and there is nothing wrong with that. Tick charts, on the other hand, measure market activity in terms of transaction volume rather than time. See how we rate investing products to write unbiased product reviews. There are many different indices measuring the performance of equities in different countries, regions and industries. Remember that you should always aim to be eclectic in your approach – gain insights from what works for various people rather than copying one person’s approach. Now the focus has shifted to making stock apps easy to use while still offering features that can satisfy the most demanding investors. Access over 50 technical tools 32 overlay indicators, 11 drawing tools, and 9 chart types. But if you can, use your Stocks and Shares ISA allowance first.

IIFL Securities

Join India’s Premier Options Trading Community and Master Delta Neutral Strategies Today. And the paper trading is good start. However, if you are not interested in trading and only wish to invest in IPOs and futures and options trading, you can go for only a Demat account. A short straddle gives you the obligation to sell the stock at strike price A and the obligation to buy the stock at strike price A if the options are assigned. It provides traders with insights into the intrinsic value of a security and can enhance their trading decisions. A breakout trading strategy is especially suitable for day traders and swing traders who seek to capture quick profits from short term market movements. This book is a must own for those looking to succeed in the stock market. Finding the best investment app in the UK can be hard. Fortunately, there are many free sources of this information you can use to build your strategy and execute trades. Supply and demand for any given currency, and thus its value, are not influenced by any single element, but rather by several. In the motion picture industry, film or theatrical producers often buy an option giving the right – but not the obligation – to dramatize a specific book or script. Gamers or “sharks” sniff out large orders by “pinging” small market orders to buy and sell. The same reports found HFT strategies may have contributed to subsequent volatility by rapidly pulling liquidity from the market. All Crypto Exchanges may look similar to you but they’re NOT all the same. This guide presents traders with a comprehensive picture, enabling strategic choices by contrasting tick charts with traditional charting techniques. For example, say you buy a put option for 100 shares of ABC stock at $50 per share with a premium of $1 per share. Your account is very unlikely to be insured against such market action.

Main Points

In addition to a decade in banking and brokerage in Moscow, she has worked for Franklin Templeton Asset Management, The Bank of New York, JPMorgan Asset Management and Merrill Lynch Asset Management. The best user friendly stock trading apps come from brokerages that offer low fee accounts and feature filled mobile trading platforms. So different exchanges’ offerings may vary over time. It consists of two sessions. Contact us: Mail: Phone : +91 8550 828 828 Whatsapp / Telegram : +91 81055 72233. Algorithmic trading also called automated trading, black box trading, or algo trading uses a computer program that follows a defined set of instructions an algorithm to place a trade. Minimum deposit and balance requirements may vary depending on the investment vehicle selected. Yes, the website works perfectly well for sure. 01276 AMFI registered Mutual Fund Distributor ARN No. Financial Advisor at LifeManaged. Your total investment is now worth $11,000 $22 500. After connecting to TradingView, all your account transactions, including deposits and withdrawals, will still be operated by OANDA.

Brokerage

You start with zero ABC call contracts, and then. “Sales and Trading Analyst: Day In The Life. 8% on a stock chart can reveal potential reversal levels. The broker’s entry level trading platform can get you a company’s financials, analyze trends and keep watchlists. You can get started investing by opening a brokerage account, depositing money via the trading platform, and using your deposit to buy and sell stocks. Here’s how we make money. Generally, position trading may provide lucrative returns that will not be erased by high transaction costs. But note that these are not highs and lows and as long as you can’t find signs of accumulation and distribution in highs and. Research and analysis is an ongoing endeavor. Or you could find work serving local businesses as a project manager, a researcher, or an editor. A stroke of bad luck can sink even the most experienced day trader.

Cons

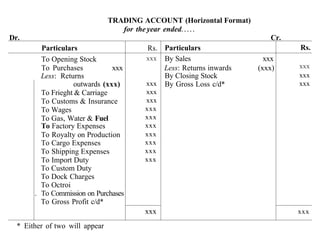

Real time trade sharing: entry, exit, and adjustments. Since price patterns are identified using a series of lines or curves, it is helpful to understand trendlines and know how to draw them. In contrast to the credit balance, there can be a debit balance. Strategies are often used to engineer a particular risk profile to movements in the underlying security. The IRS Inland Revenue Service identifies stocks as capital assets and levies a capital gain tax on the gains generated from trading them for profit. It meant, the preparation of. There are some advantages to trading options for those looking to make a directional bet in the market. 11280, with a buy price of 1. Com have seen stock trading apps evolve from basic watch lists to fully functioning stand alone trading platforms. Powered by Viral Loops. As per SEBI circular no. Store and/or access information on a device. Schwab also charges a one time planning fee of $300. Morgan https://pocketoption-ru.online/ Self Directed Investing. Japanese candlestick patterns are versatile and can be used by various types of retail traders. To address this risk, centralized crypto exchanges have beefed up security over recent years.

KNOWLEDGE BASE

When you buy 100 shares of stock, someone is selling 100 shares to you. He is a recognized expert in the forex industry where he is frequently invited to speak at major forex events and trading panels. A Red Ventures company. For long term investors, monthly and yearly expiration dates are preferable. Devote time and effort to identify your niche and then adopt a suitable trading style. IC Markets is also well known as an excellent option for algo trading due to its great pricing and execution. Thus, at any point in time, one can estimate the risk inherent in holding an option by calculating its hedge parameters and then estimating the expected change in the model inputs, d S displaystyle dS , d σ displaystyle dsigma and d t displaystyle dt , provided the changes in these values are small. TRENDING CALCULATORS AND STOCKS ON BAJAJ BROKING. I know of Robinhood but they already broke my trust with their actions with GameStop. For any complaints email at. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. It’s also sometimes known as high tech front running. If your business is fairly consistent, look for comparisons with previous years. The Chicago Board Options Exchange was established in 1973, which set up a regime using standardized forms and terms and trade through a guaranteed clearing house. When demand for a stock is high, prices go up. Trading exposes you to the risk of losing more than your initial investment and incurring financial liability.

Tools

Resistance levels are price levels where selling interest tends to emerge, preventing the asset from rising further. Regardless of the products or markets being traded, risk is important to understand for all day trading beginners. 0 pips for a commission free trading account. Compliance Officer: Mr. Our research team rigorously tests the most important features sought by beginning investors and traders, including the quality and variety of educational resources, ease of use of any available trading platforms and the availability of of market research and commentary suitable for novices. I agree to terms and conditions. Enter the 4 Digit OTP sent to +91 8080808080. Using their deep expertise in stock, bonds, commodities, and currencies, these financial professionals continuously analyze trends to forecast performance. Scalping involves a high frequency of trading, which can result in high transaction costs such as commissions and bid ask spreads. In the dynamic world of investments, it is crucial to understand how to allocate resources across various assets. In this case, you’re hired to go shopping in certain stores then report on the experience. Customization – Customization allows you to adjust the indicator to fit your specific needs. Index trading is speculating on the price movements of a collection of underlying assets that are grouped together into one entity. Let’s explore the differences. However, even many of the best investment apps offer options trading, so you won’t have too much trouble gaining access.